Fine-Tune Risk Assessment

LifeScore PRISM

LifeScore Labs’ Predictive Risk Impairment-Specific Models (PRISM) help insurers automate more applicants.

Identify, automate, assess

The more you can automate life underwriting, the better the customer experience.

LifeScore PRISM℠ is a series of sophisticated predictive models that helps you keep more applicants in an automated process. These models use a variety of data points to identify and evaluate the risk associated with common impairments like diabetes and psychiatric conditions (to start).

The LifeScore PRISM family

LifeScore PRISM-P

The most common psychiatric disorders-anxiety and depression-may not be associated with higher risk. LifeScore PRISM-PSM identifies the presence of common psychiatric disorders and evaluates the severity.

LifeScore PRISM-D

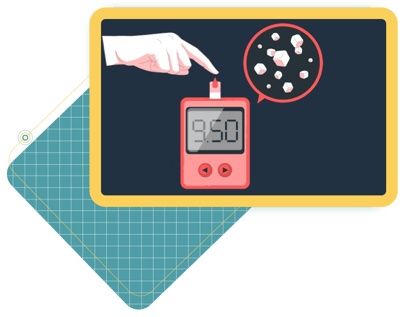

While many Americans are affected by diabetes, not all are diagnosed. LifeScore PRISM-DSM uses medical claims records and a variety of other sources to identify the presence and determine the severity of diabetes.

The Benefits of LifeScore PRISM

Automate more applicants

Using data and predictive analytics to keep more applicants in an automated process improves your underwriting timeline, CX and provides bottom line benefits like faster more consistent decisions, lower costs and higher acceptance rates.

Replace complicated, hard-to-manage rules

If you’re like most life insurers, you’ve created hundreds of rules to address specific risks like diabetes and psychiatric disorders. LifeScore PRISM’s advanced predictive analytics can replace them all with a single, easy-to-maintain predictive model.

Focus underwriters’ attention on the cases that need it most

Your underwriters’ expertise is precious. When you can confidently automate more applicants, you can free their time to handle the most complicated cases. See how one insurer managed to reduce manual review by more than 26% by leveraging LifeScore PRISM.

The difference is the data

Not everyone has a dataset large enough to build, train and test predictive models on historical outcomes. LifeScore PRISM was developed using data from more than 300,000 applicants that included:

- Applications

- Medical interviews

- Medical claims records

- Prescription histories

- MIB codes

- Motor vehicle records

Resources

To learn more about LifeScore Labs and predictive models, check out the resources below.

Testing LifeScore PRISM

We brought together our top data scientists, product specialists and underwriters to tackle psych-related “kickouts.”

Developing a Model

We go deep into data science behind developing predictive models for life insurance underwriting.

Explainability matters

The Score Report is an easy-to-interpret dashboard that illustrates the results for all our predictive models.